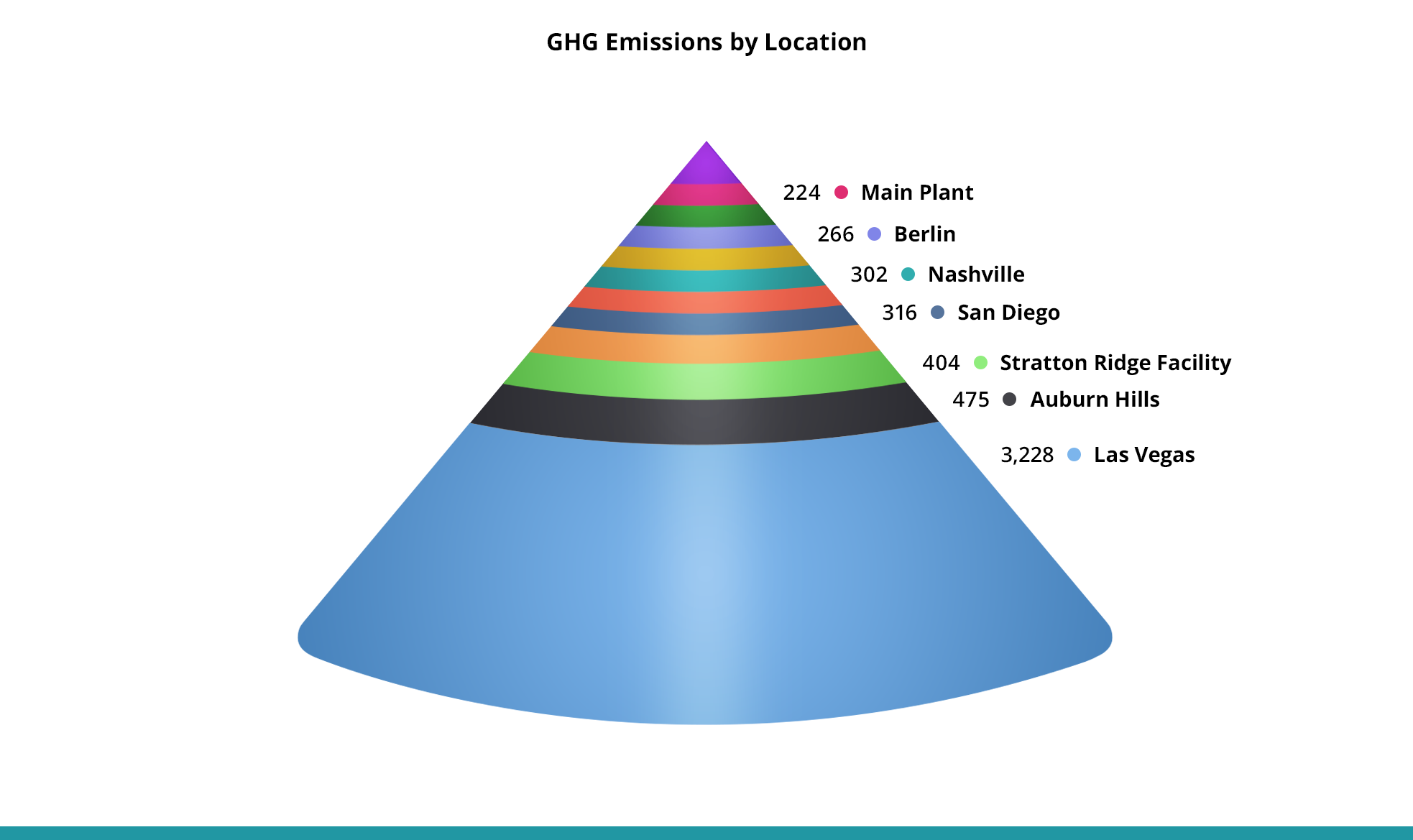

On March 21st, the Securities and Exchange Commission (SEC) took the first steps towards codifying Environmental, Social, and Corporate Governance (ESG) disclosure requirements related to environmental reporting. The SEC announced the proposal and released its proposed rules to standardize several climate-related disclosures. These disclosure requirements target climate-related risk impacts and management, as well as encompass Scope 1, Scope 2, and Scope 3 greenhouse gas (GHG) emissions data.